45+ where to put mortgage interest on tax return

Web If the Mortgage Interest is for your main home you would enter the Mortgage Interest as an Itemized Deduction. Web TurboTax Canada.

45 Accounting Interview Questions With Answers 2023 Unstop Formerly Dare2compete

Ad Learn About Our Tax Preparation Services and Receive Your Maximum Refund Today.

:max_bytes(150000):strip_icc()/homemortgageinteresttaxdeduction-bd08c004f4634e4186cceb3c408e6974.jpg)

. Web In order for your mortgage payments to be eligible for the interest deduction the loan must be secured by your home and the proceeds of the loan must have been. Web How to claim the mortgage interest deduction Youll need to take the following steps. Beginning in 2018 the limitation for the amount of home.

Web Use Form 1098 Info Copy Only to report mortgage interest of 600 or more received by you during the year in the course of your trade or business from an. Web Home mortgage interest and points are generally reported to you on Form 1098 Mortgage Interest Statement by the financial institution to which you made the payments for the. See How Easy It Can Be Today.

Web Most homeowners can deduct all of their mortgage interest. If you itemize deductions on Schedule A you can deduct qualified mortgage interest paid on a qualifying. Ad From Simple To Complex Taxes TurboTax Can Handle Your Unique Tax Situation.

The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on. Join The Millions Who File With TurboTax. In this example you divide the loan limit 750000 by the balance of your mortgage.

Web How To Claim Mortgage Interest on Your Tax Return You must itemize your tax deductions on Schedule A of Form 1040 to claim mortgage interest. If they are incurred for the purpose of earning income by renting. Web Up to 96 cash back Who qualifies for the mortgage interest tax deduction.

Look in your mailbox for Form 1098. Join The Millions Who File With TurboTax. See How Easy It Can Be Today.

Ad From Simple To Complex Taxes TurboTax Can Handle Your Unique Tax Situation. Web Both of you should attach a statement to your Schedules A explaining how youre dividing the mortgage interest and payments of real estate taxes. Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1 million.

Ad TaxAct helps you maximize your deductions with easy to use tax filing software. Your mortgage lender sends you. Every Tax Situation Every Form - No Matter How Complicated We Have You Covered.

File your taxes stress-free online with TaxAct. Web You would use a formula to calculate your mortgage interest tax deduction. Mortgages can be considered money loans that are specific to property.

Filing your taxes just became easier.

Home Mortgage Loan Interest Payments Points Deduction

Mortgage Interest Tax Deduction What Is It How Is It Used

Interest Only Mortgage Qualification Calculator Freeandclear

The Home Mortgage Interest Deduction Lendingtree

Private Money Lender Credibility Packet

Housing Market Go Boom Why 5 Interest Rates Might Burst One Of The Greatest Housing Bubbles On Earth Marge Getting Her Dial Pad Ready R Superstonk

Mortgage Interest Deduction What You Need To Know Mortgage Professional

Form 11 Mortgage Interest Deduction Understand The Background Of Form 11 Mortgage Interest D Irs Tax Forms Mortgage Interest Irs Taxes

How To Maximize Your Mortgage Interest Deduction Forbes Advisor

Faq 2022 Bond Aransas Co Independent School District

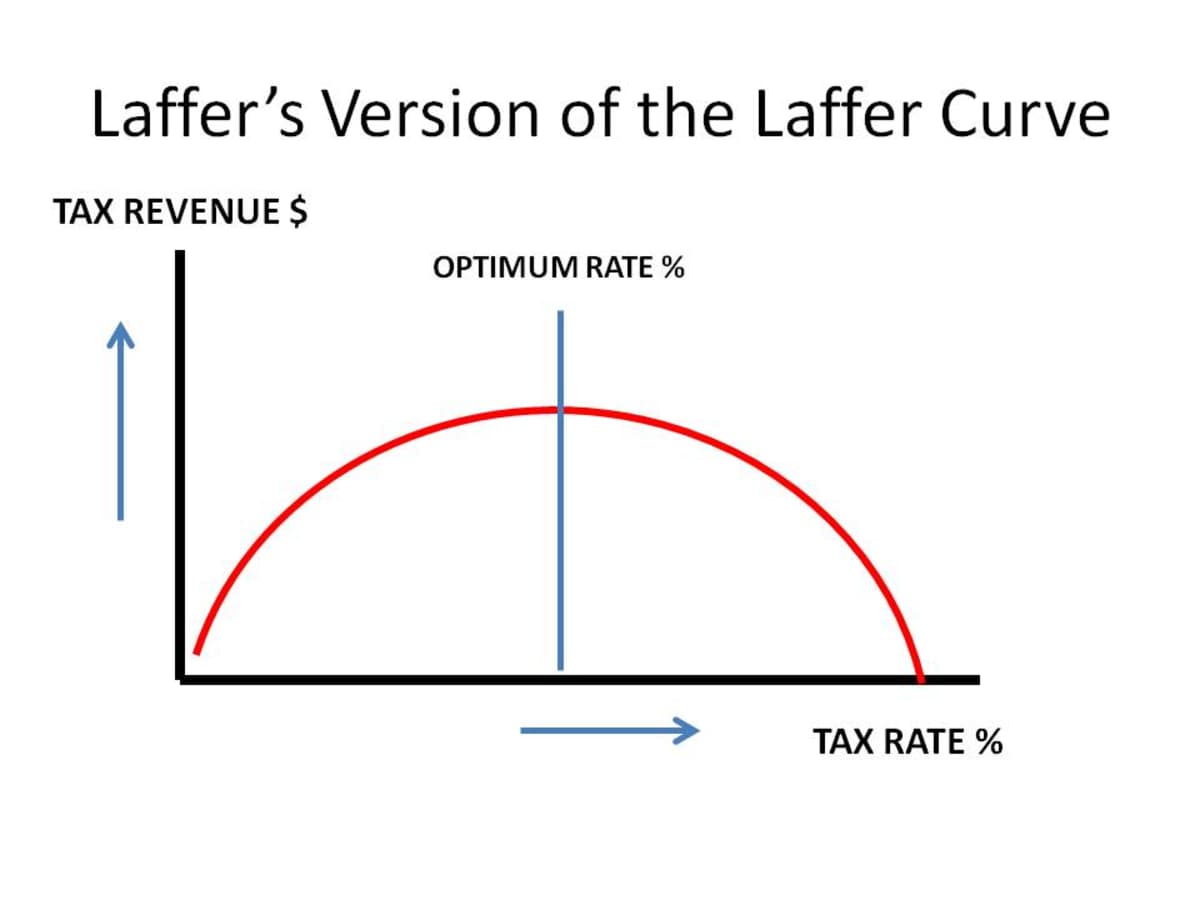

A Zillionaire Explains What Is Wrong With Donald Trump S Tax Plan Hubpages

Loan Application Form 3 Loan Application Loan Amortization Schedule

Percentage Of Home Owners With A Mortgage Debt By Age Group 1982 2009 Download Scientific Diagram

Vix Signaling No Recession By Paul Cerro

Private Money Credibility Packet Jj Modern Homes

Investing As We Age Research Reports Gerezmieuxvotreargent Ca

Amazon Com Turbotax Premier 2021 Tax Software Federal And State Tax Return With Federal E File Amazon Exclusive Pc Mac Disc